You don’t notice it at first.

You grow up believing the world runs on fairness. If you work hard, tell the truth, follow the rules and trust the system, then the right things will happen.

It sounds clean. Logical. Moral. And for a long time, you try to live exactly like that.

But then you grow up and come to realize that something doesn’t quite line up. You can feel it before you can explain it.

You watch ordinary people lose everything over small mistakes. A missed payment. A bad investment. A wrong decision at the wrong time. Consequences arrive fast and personally. Homes are repossessed. Careers collapse. Names are stained.

At the same time, you watch powerful institutions implode spectacularly – yet they somehow survive.

That’s when the question begins to form :

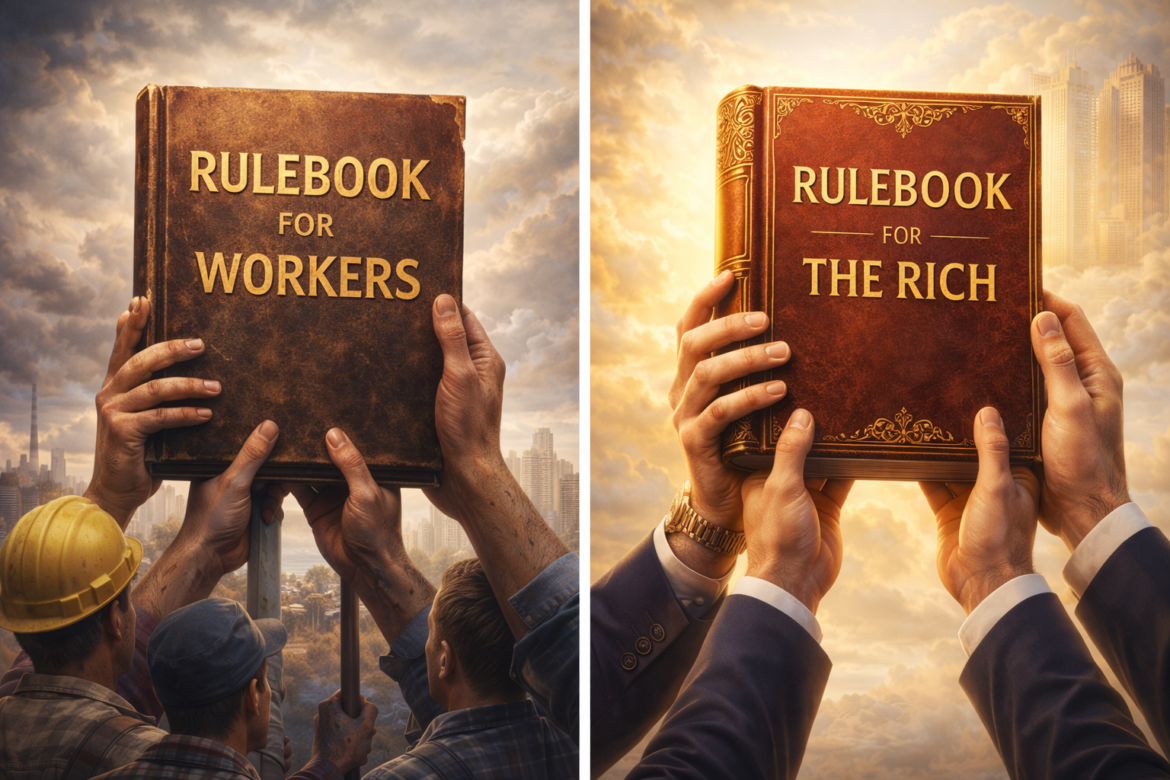

Are there two rulebooks in society?

One for the powerful, and one for everyone else.

The Rulebook You Were Given

The first rulebook is familiar.

It’s handed to you at school, reinforced at work, repeated by authority figures :

- Play fair.

- Pay your taxes.

- Obey the law.

- Trust institutions.

- Don’t cut corners.

If you break these rules, the consequences are swift.

You can’t negotiate a speeding ticket with charm and connections.

You can’t restructure your mortgage with a handshake.

You can’t quietly settle criminal charges in a private room.

The public rulebook is rigid, and it is enforced downward.

That’s important.

It creates order, stability, predictability, and a sense of moral structure. But it also creates something else.

Compliance.

Most people never question it. They internalize it, and believe the system is built on equal enforcement.

Until they start noticing patterns.

When the Banks Fell — And Didn’t

In 2008, the global financial system cracked open. You may know it as ‘The Global Financial Crisis’ (GFC).

The collapse of Lehman Brothers sent shockwaves across the world. Markets crashed, retirement accounts evaporated, many families lost their homes and small businesses closed.

Ordinary people absorbed the impact. But what happened to the architects of the collapse?

Major financial institutions were rescued. Bailouts were issued. Liquidity was injected. The system was stabilized – not by punishing the institutions at the top, but by protecting them.

The reasoning was pragmatic. “Too big to fail.” The collapse would have been worse otherwise.

But here’s the perception that lingered :

When individuals fail, they fall.

When institutions fail, they are rescued.

That’s not conspiracy. That’s observable hierarchy.

The public rulebook says : Manage risk responsibly or face consequences.

The private rulebook says : If you’re systemically important enough, you become the consequence everyone fears.

And fear changes enforcement.

The Epstein Moment

Then came the scandal around Jeffrey Epstein.

Whatever one believes about the specifics, what shook the public consciousness wasn’t just the crimes alleged. It was the network.

The photographs. The associations. The powerful names orbiting the story – including figures like (Prince) Andrew, Bill Clinton, Donald Trump and Bill Gates – all who were publicly linked to Epstein in various contexts.

Again, this isn’t about declaring guilt. It’s about perception :

The perception that power cushions impact.

The perception that outcomes differ depending on status.

The perception that some scandals are negotiated while others are prosecuted.

Epstein’s death intensified the suspicion. It fed a broader narrative that powerful networks protect themselves, intentionally or structurally.

True or not in every detail, the emotional takeaway was clear : Access changes outcomes. And when people believe that, trust erodes.

The Hierarchy of Consequences

Now Consider looking wider.

Corporations break environmental regulations and pay fines that represent a fraction of annual profits.

An individual breaks a regulation and may face criminal charges.

Politicians create lockdown rules – and are later photographed bypassing them.

Celebrities face tax investigations and negotiate settlements.

Large companies engage in questionable financial practices and sign deferred prosecution agreements.

The pattern isn’t that rules disappear at the top. It’s that consequences become negotiable.

Money buys lawyers.

Status buys time.

Networks buy protection.

Influence shapes narrative.

At the bottom of the hierarchy, enforcement is direct. At the top, enforcement is strategic.

That’s the uncomfortable truth behind the idea of two rulebooks in society.

The System Isn’t Broken

This is where most commentary goes wrong.

People protest and shout that the system is broken. But what if it isn’t? What if it is functioning exactly as power structures always have?

Hierarchies protect themselves.

Institutions prioritize stability over fairness.

Power concentrates, and concentrated power resists collapse.

This doesn’t make it moral. but it does make it predictable.

And predictability is far more useful than outrage.

The Illusion of Equal Rules

We are raised to believe the rulebook is universal.

But rules are tools. And tools serve purposes.

Sometimes the purpose is justice.

Sometimes the purpose is order.

Sometimes the purpose is control.

The public rulebook needs to maintain social cohesion. It keeps traffic moving, contracts enforceable, workers working (and paying taxes), and schools functioning.

Without it, chaos.

But the private rulebook protects the hierarchy itself. And hierarchies, by design, preserve their own continuity.

This isn’t new. History is full of examples where elites operated under softer constraints than citizens. Monarchies. Industrial magnates. Political dynasties.

The difference today is visibility.

We see more. And what we see doesn’t always match what we were told.

Why This Matters for You

NoRuleBook isn’t about chaos or reckless rebellion. It’s about awareness.

If there are two rulebooks in society – one public and one private – Then blindly worshipping the public one without understanding the private one is naïve.

Sure, you cannot control how elites operate, and you cannot rewrite global power structures overnight. But you can stop assuming the system is purely moral.

You can start by asking better questions :

- Who benefits from this rule?

- Who enforces it?

- Who is exempt from it?

- What leverage would change the outcome?

Most people live trying to be perfectly compliant. But compliance without leverage creates vulnerability.

The powerful don’t necessarily break rules more often, but they understand leverage better :

- They negotiate.

- They settle.

- They reposition.

- They build networks that soften consequences.

That’s the deeper lesson.

The Risk of Obedience

The real risk isn’t that powerful people operate differently. The real risk is spending your entire life believing the rulebook was designed for your protection when often it was designed for system stability :

- You follow the script.

- You trust authority.

- You aim to be “good.”

Yet you never question whether the ladder you are encouraged to keep climbing actually leads anywhere you actually want to go.

Understanding unequal justice or selective enforcement of laws isn’t about bitterness. It’s about strategic clarity.

Once you see hierarchy clearly, you stop being shocked by it. You start building position instead of permission. You stop asking, “Is this fair?” and you then start asking, “How does this actually work?”

The NoRuleBook Lesson

If there are two rulebooks in society, you were probably only handed one. But that doesn’t mean abandoning morality. It means stopping the confusing of morality with power.

The world operates on layers. The public layer of rules. And the private layer of negotiation. The most dangerous position is ignorance. The most powerful position is awareness. You don’t need to rage against elites, but you need to understand structure. Because once you see the structure, you stop living as if the system is perfectly symmetrical. You start making decisions with eyes open. And this is the first real step to living outside the unwritten rules of society.

Not by smashing the system. But by seeing it clearly, and refusing to be naïve inside it.